Ahmedabad Municipal Corporation (AMC) collects an annual property tax on every residential, commercial, and industrial property. The revenue funds essential services like waste management, street lighting, and drainage.

Rates for FY 2025 are ₹16 per sq m for homes and ₹28 for non‑residential units, with minimum half‑yearly slabs for tiny shops, chawls and huts. Pay online via the AMC portal or app, or at 60+ civic centres. Instalments fall due 31 March and 15 October; late dues attract 2 % monthly interest. April advance payments unlock rebates up to 12 % plus online bonuses.

AMC Property Tax Rates 2025

| Use category | Base rate (₹ / sq m) |

|---|---|

| Residential | ₹ 16 |

| Non‑residential | ₹ 28 |

Minimum Half Yearly AMC Property Tax Payable for Non-Residential Buildings

| Property type | Carpet area (sq m) | Minimum tax (₹) |

|---|---|---|

| Shops / offices / similar | < 15 | 540 |

| 15 – 30 | 660 | |

| > 30 | 780 | |

| Special uses* | – | 900 |

Suggested Read: Home Loans in Ahmedabad

Minimum Half Yearly AMC Property Tax Payable for Residential Buildings

| Property type | Carpet area (sq m) | Minimum tax (₹) |

|---|---|---|

| Hut | – | 84 |

| Chawl | < 25 | 264 |

| Other | < 30 | 264 |

| Other | 30 – 50 | 300 |

| Other | > 50 | 330 |

Suggested Read: Cost of Living in Ahmedabad

How to Pay AMC Property Tax Online?

- Visit the official Ahmedabad Municipal Corporation portal.

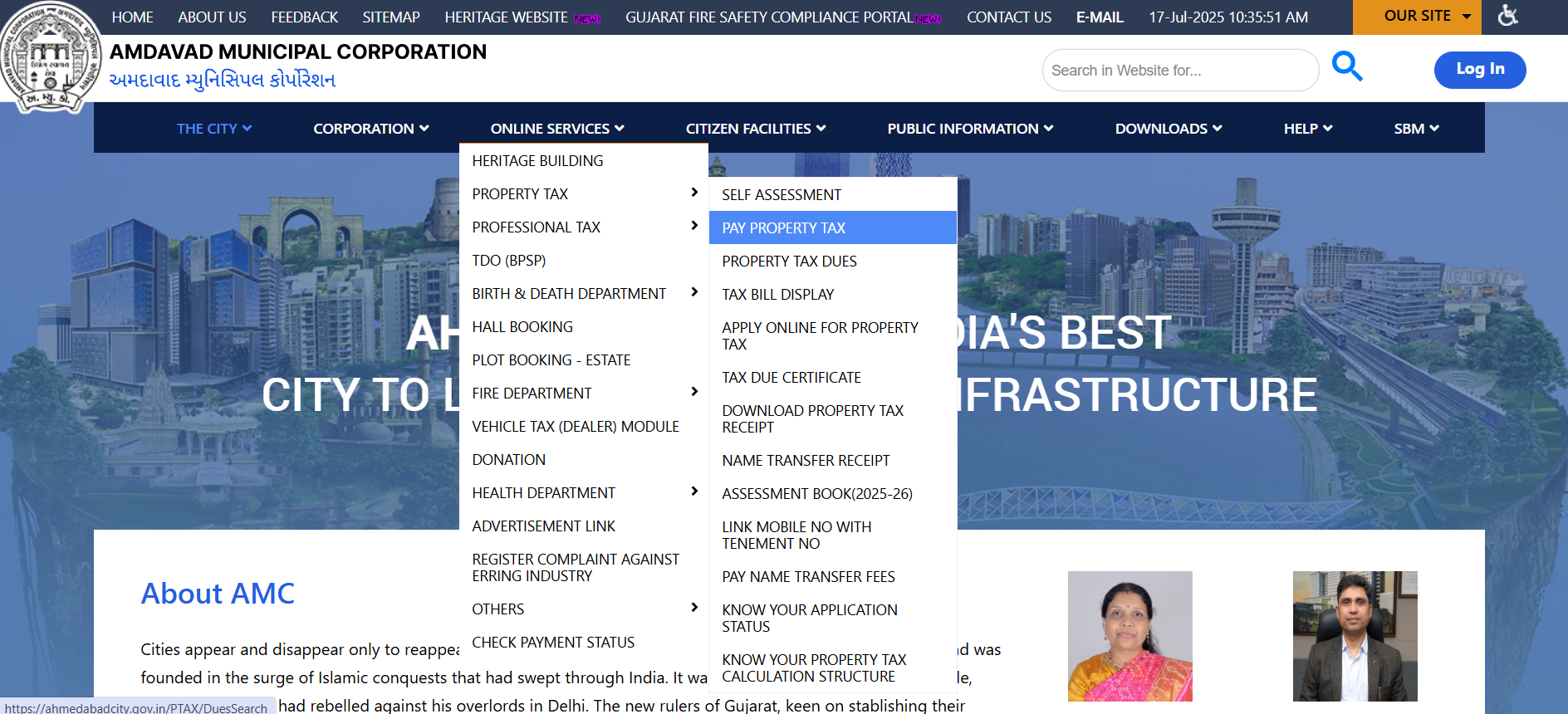

- Home page ➜ Online Services ➜ Property Tax ➜ Pay Property Tax.

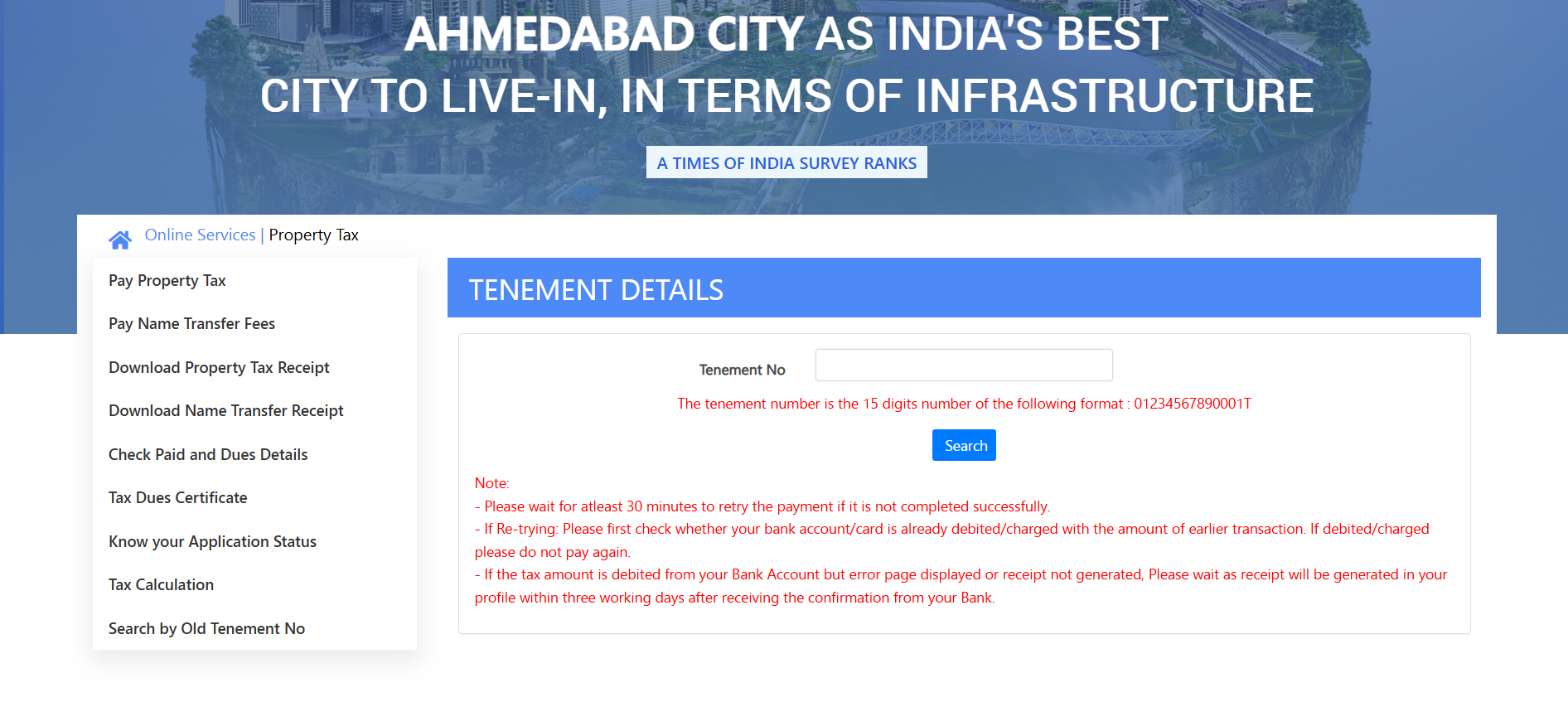

- Enter the 15‑digit code and hit Search to fetch your latest dues.

- Confirm owner name, property address, outstanding amount, and any arrears. Click Pay once everything looks correct.

- You’ll be redirected to a secure payment gateway. Pay via debit card, credit card, net‑banking, or UPI as offered.

- A Transaction Reference Number (TRN) appears on‑screen and via SMS/email.

Suggested Read: Why Investing in Gujarat Real Estate is a Smart Move?

How to Pay AMC Property Tax in Person?

Walk into any of AMC’s 60‑plus civic centres, submit your tenement number at the counter, and pay by cash, cheque, demand draft, debit/credit card, or UPI. Here are a few busy centres:

| Civic Centre | Address | Public Hours* |

|---|---|---|

| Sardar Bag | Near Air India Office, Opp. Sardar Bag | 09:00 – 16:30 |

| Shahpur | Ward Office, Beside Bapu Smruti Kunj Rd. | 09:00 – 16:30 |

| Virat Nagar | Harubhai Mehta Bhavan, Bapunagar | 09:00 – 19:30 |

| Rajpur | Sub‑Zonal Office, Baliyakaka Rd. | 09:00 – 16:30 |

| Behrampura | Beside Torrent Power Sub‑station | 09:00 – 16:30 |

| Maninagar | Opp. Maninagar Fire Station, Rambaug | 09:00 – 19:30 |

| Memco | Rajiv Gandhi Bhavan, Naroda Rd. | 09:00 – 19:30 |

Suggested Read: RERA Charges in Gujarat

How to Pay AMC Property Tax Using a Mobile App?

- Launch the Ahmedabad AMC app and sign up with your name, mobile number, and email.

- Tap Property Tax, enter your 15‑digit tenement number, and confirm the displayed dues.

- Choose card/UPI/net‑banking, press Submit, and receive instant confirmation

Suggested read: Gujarat Housing Board Schemes in 2025

How to Download AMC Property Tax Receipt Online?

- Go to Online Services → Property Tax → Download Property Tax Receipt.

- Enter the tenement number; click Search Paid.

- Download Bill or Print to get a copy.

Suggested Read: Stamp Duty and Registration Charges in Gujarat

How is Ahmedabad Property Tax Calculated?

Tax payable = Carpet Area (sq m) × Base Rate (residential / non‑residential) × F1 × F2 × F3 × F4

| Factor | What it reflects | Typical reasoning |

|---|---|---|

| Carpet Area (sq m) | Net usable floor space of the unit | Larger area → higher tax |

| Base Rate | ₹ 16 (residential) or ₹ 28 (non‑residential) per sq m | Fixed by AMC each budget year |

| F1 – Location | Market value of the neighbourhood (premium, normal, or low‑value zone) | Prime localities pay more |

| F2 – Building Type | Weightage for construction category (bungalow, apartment, chawl, hut, etc.) | Robust structures pay higher |

| F3 – Age | Depreciation credit for older buildings | New = full rate; older = discount |

| F4 – Occupancy | Whether the unit is self‑occupied, rented, or vacant | Rented units incur a slight premium |

| Fn – Use | Residential vs. commercial/industrial usage | Non‑residential attracts extra weight |

Suggested Read: Gujarat Land Records (AnyRoR)

AMC Administrative Map

| Zone | Constituent wards |

|---|---|

| North | Bapunagar, Kubernagar, Naroda, Saijpur Bogha, Sardar Nagar, Saraspur‑Rakhial, Thakkarbapanagar |

| North‑West | Bodakdev, Chandlodia, Ghatlodia, Gota, Thaltej |

| Central | Asarwa, Dariapur, Jamalpur, Khadia, Shahibaug, Shahpur |

| East | Amraiwadi, Bhaipura‑Hatkeshwar, Gomtipur, Nikol, Odhav, Ramol‑Hathijan, Vastral, Virat Nagar |

| West | Chandkheda, Naranpura, Nava Vadaj, Navrangpura, Paldi, Ranip, Sabarmati, S. P. Stadium |

| South‑West | Jodhpur, Maktampura, Sarkhej, Vejalpur |

| South | Behrampura, Indrapuri, Isanpur, Khokhra, Lambha, Maninagar, Vatva |

Suggested Read: Affordable Home Loans Offered by HFCs

AMC Property Tax Payments Due Dates

- 31 March – first (half‑yearly) instalment

- 15 October – second (half‑yearly) instalment

AMC Property Tax Recent Rebate History

| Financial Year | Rebate Window & Conditions | Discount Offered |

|---|---|---|

| FY 2025‑26 | Advance payment before official window closes; extra perks for online and loyal payers | 12 % base + 1 % online + 2 % three‑year advance |

| FY 2024‑25 | Bills cleared on or before 30 July 2024 | 10 % |

| FY 2023‑24 | 18 Apr – 17 May 2023 advance period; additional reward for three‑year pre‑payment | 12 % + 2 % |

| FY 2022‑23 | Any advance payment during the year | 10 % |

AMC Property Tax Late Payment Penalty

AMC levies a 2 % monthly surcharge on any outstanding amount, automatically added to the next property‑tax bill until the dues are cleared.

How to Pay AMC Property Tax in Advance?

- April window: AMC opens its advance‑payment option each April (exact dates appear in the budget notice).

- Log in: Use the AMC portal or Ahmedabad AMC app → Online Services → Property Tax → Advance Payment.

- Fetch dues: Enter your 15‑digit tenement number to display the full‑year tax and rebate.

- Verify: Check property details and the rebate percentage shown on‑screen.

- Pay: Settle the entire amount in one go via card, UPI, net‑banking, or wallet to secure the discount.

- Save proof: Download the e‑receipt and note the TRN to confirm both instalments are cleared.

AMC Customer Care

If you have any questions or need assistance with your Ahmedabad property tax payment, you can contact the AMC support team through the following:

| Mode of Communication | Contact Information |

|---|---|

| Helpline Number | 155303 |

| Email Address | info@ahmedabadcity.gov.in |

| Contact Numbers | 079-27556182 079-27556183 079-27556184 079-27556187 |

Conclusion

Paying property tax is not just a legal obligation, but a collective responsibility towards ensuring that Ahmedabad remains a well-functioning and livable city. The AMC property tax is vital for the continuous development of infrastructure, making life better for residents.

Looking to buy a home? Let Credit Dharma make it simple with our hassle-free home loans. We’ll help you turn your dream home into reality, without the stress of complicated paperwork.

Frequently Asked Questions

All property owners, including those with residential, commercial, or industrial properties, must pay property tax.

Penalties are added to the total amount due for late payments based on the delay period.

AMC offers early payment discounts, which vary yearly. Check the AMC website for current offers.

Yes, you can file an appeal with AMC if you believe your tax assessment is incorrect.

AMC property tax is usually due annually in June/ July, with specific dates announced by the corporation each year.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan