When you’re ready to buy your dream home, the ICICI home loan apply process is here to help. This quick guide will give you all the essential information you need to start your application.

Whether you prefer applying online or visiting a branch, ICICI Bank makes the process straightforward and accessible. Let’s take the first step together towards securing your new home with ICICI Bank.

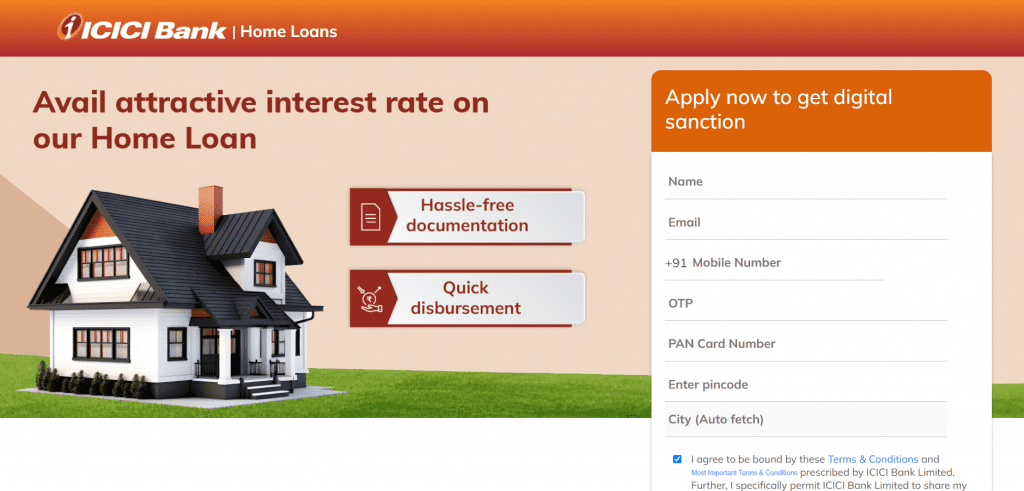

ICICI Bank Home Loan: Online Application Process

Applying for an ICICI home loan online is simple. Here’s how you can start your application right away.

- Visit the ICICI Website:

First, go to the ICICI Bank website. Look for the home loan section and click on “Apply Now” to find all the details you need.

- Enter Your Details:

Next, fill in your personal and professional information. Specifically, this includes your age, income, and the type of job you have.

- Check Your Loan Eligibility:

After entering your details, the website will show if you qualify for a home loan and how much you can borrow.

- Choose your loan options:

Then, decide how much money you want to borrow and the time you need to pay it back.

- Provide Property Information:

Then, provide details about the property you want to buy with the loan.

- Learn About Fees:

The website will also tell you about any fees or charges that come with the loan.

- Submit Your Application:

Once you have filled everything out, submit your application. You can do this easily online through the website.

- Upload Documents:

You will need to upload some documents like your ID and income proof. The website will guide you on how to do this.

- Wait for Approval:

Finally, after you submit everything, ICICI Bank will review your application. They will let you know if your loan is approved.

- Get Your Loan:

Once approved, ICICI Bank will process your loan. They will send the money to the seller or builder of your new home.

Check Out: CIBIL Score Required for ICICI Home Loan Approval

ICICI Bank Home Loan: Offline Application Process

For those who prefer a traditional approach, the offline application process offers a straightforward alternative.

- Visit the nearest ICICI Bank branch.

- Consult with a loan officer.

- Collect and arrange required documents.

- Fill out the home loan application form.

- Submit the application and pay the processing fee.

- Undergo verification and loan assessment.

- Property evaluation and legal check.

- Receive loan sanction and offer letter.

- Sign the loan agreement and complete formalities.

- Loan disbursement and start EMI payments.

Also Read: ICICI Home Loan Insurance Benefits

ICICI Home Loan Application Process with Credit Dharma

- Visit Credit Dharma’s official website.

- Enter your name, city of residence, and mobile number.

- Choose your preferred loan type, for example, “home loan”.

- Enter the OTP and click on “verify.”

- Enter your property details, employment type, income, and CIBIL score.

- Now sit back and relax. Home Loan Experts from Credit Dharma will call you within the next 24 Hours.

Also Read: ICICI Bank Home Loan Processing Fees

ICICI Bank Home Loan Application Approval to Disbursement Stages

| Stage | Description |

|---|---|

| Loan Approval Notification | Receive loan approval notification via email/SMS, including approved loan details. |

| Loan Agreement Signing | Receive a formal sanction letter with final loan amount, interest rate, EMI, and loan tenure. |

| Submission of Original Documents | Submit all required original property documents and sale agreements. |

| Verification of Documents | ICICI Bank conducts legal and technical verification of submitted documents. |

| Final Sanction Letter Issuance | Receive a formal sanction letter with the final loan amount, interest rate, EMI, and loan tenure. |

| Payment of Processing Fees | Submit a formal request for disbursement with supporting documents (e.g., builder’s demand letter). |

| Request for Loan Disbursement | Submit formal request for disbursement with supporting documents (e.g., builder’s demand letter). |

| Loan Amount Disbursal | Begin regular EMI payments as per the repayment schedule in your loan agreement. |

| Loan Repayment Commencement | Begin regular EMI payments as per repayment schedule in your loan agreement. |

Also Read: How to Track Your Application Status?

How Long Does it Take to Process a Home Loan Application?

| Stage | Key Activities | Estimated Time | Factors Affecting Time |

|---|---|---|---|

| 1. Application Submission | Submit application (online/offline) with documents. | Online: Instant Offline: 1–2 days | Document completeness, submission mode (online vs. offline). |

| 2. Eligibility Check | Credit profile, income stability, and existing debts. | 3–5 business days | Credit profile, income stability, existing debts. |

| 3. Property Valuation | Credit score assessment, income verification, and debt analysis. | 3–7 days | Property type (under-construction/ready), legal clarity. |

| 4. Loan Sanction | Approval of loan amount, interest rate, and terms. | 2–3 days post-valuation | Compliance with LTV ratio, valuation report. |

| 5. Legal & Technical Check | Verify property title, ownership, structural safety, and regulatory approvals. | 5–10 days | Property disputes, regulatory compliance, builder delays. |

| 6. Documentation | Loan agreement signing, mortgage registration, EMI setup. | 1–3 days | Applicant responsiveness, document accuracy. |

| 7. Disbursement | Funds transferred to seller/builder. | 1–3 days (ready property) | Builder coordination, escrow formalities. |

Total Processing Time

- Best Case: 2–3 weeks (ready property, no delays).

- Typical Case: 4–6 weeks (standard processing).

- Under-Construction: 6–8 weeks (phased disbursement).

Also Read: What to Do Once Your Home Loan Gets Rejected?

Get a Home Loan

with Highest Eligibility

& Best Rates

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Also Read: ICICI Home Loan Interest Rates 2025

Conclusion

Navigating the ICICI home loan apply process is not only simple but also direct. By preparing your documents, checking your eligibility, and understanding the loan terms, you’re well on your way to securing financing for your new home. Additionally, With these practical steps, ICICI Bank makes sure you can approach your home buying journey with ease and confidence.

Start your application today and step closer to owning your dream home. Furthermore, Turn to Credit Dharma for expert financial advice and the best home loan options tailored for you.

Frequently Asked Questions

You can either apply online at ICICI’s website or, alternatively, visit a nearby branch to start your application.

You will need ID proof, income proof, property details, and recent bank statements.

Approval can take a few days to a few weeks, depending on your documents and application accuracy.

Indeed, you can easily track your loan status by simply logging into your account on the ICICI Bank website.

Interest rates start at 8.75% but can vary based on your credit score and loan details.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan