The Rajiv Gandhi Awas Yojana (RAY) is a government initiative aimed at providing affordable housing to slum dwellers and the urban poor. Launched with the goal of making India slum-free, the scheme focuses on offering permanent housing with basic amenities like water, sanitation, and electricity. In this blog, we’ll walk you through the key details of the Rajiv Gandhi Awas Yojana, including its eligibility, benefits, application process, and the financial assistance available.

Who Can Apply for Rajiv Gandhi Awas Yojana?

The Rajiv Gandhi Awas Yojana (RAY) is specifically designed to assist slum dwellers and economically weaker sections of society in urban areas. To ensure that the benefits reach those who need them the most, the scheme has specific eligibility criteria that applicants must meet.

| Eligibility Criteria | Details |

|---|---|

| Target Group | Slum dwellers in urban areas (notified and non-notified slums) |

| Categories of Eligibility | Category A: Urban areas with a population of 5 lakh or more Category B: Urban areas with a population below 5 lakh Category C: Special category states & North-Eastern states |

| Income Criteria | Low-income groups (EWS/LIG) without owning a pucca house anywhere in India |

| Type of Housing | Must live in a kutcha (temporary) house or own land |

| Priority | SC, ST, minority populations, and women are given preference |

| Minimum Project Size | At least 250 dwelling units (DUs) in the project area |

Suggested Read: WB Affordable Housing For All

What Are the Benefits of Rajiv Gandhi Awas Yojana?

- Affordable Housing: Provides permanent, safe homes for slum dwellers and the urban poor.

- Basic Civic Infrastructure: Ensures access to clean water, sanitation, electricity, and paved roads.

- Financial Support: Offers up to ₹5 lakh per dwelling unit to reduce the cost of housing.

- Credit Support: Provides interest subsidies on long-term loans through Rajiv Rinn Yojana.

- Skill Development: Enhances employability and income potential through skill training programs.

- Slum Eradication: Works towards transforming slums into organized, formal housing areas.

- Community Empowerment: Promotes community development and reduces marginalization through participation.

Suggested Read: Everything About Home Loan Subsidies

Documents Required for Rajiv Gandhi Awas Yojana

| Document Type | Required Documents |

|---|---|

| Identity Proof | ◌ Aadhaar Card ◌ Voter ID ◌ PAN Card |

| Address Proof | ◌ Utility Bills ◌ Passport ◌ Ration Card |

| Income Proof | ◌ Salary Slips ◌ ITR (Income Tax Return) ◌ Bank Statements |

| Property Documents | ◌ Title Deed ◌ Sale Agreement ◌ Property Valuation Certificate |

| Age Proof | ◌ Birth Certificate ◌ School Leaving Certificate |

How to Apply for Rajiv Gandhi Awas Yojana?

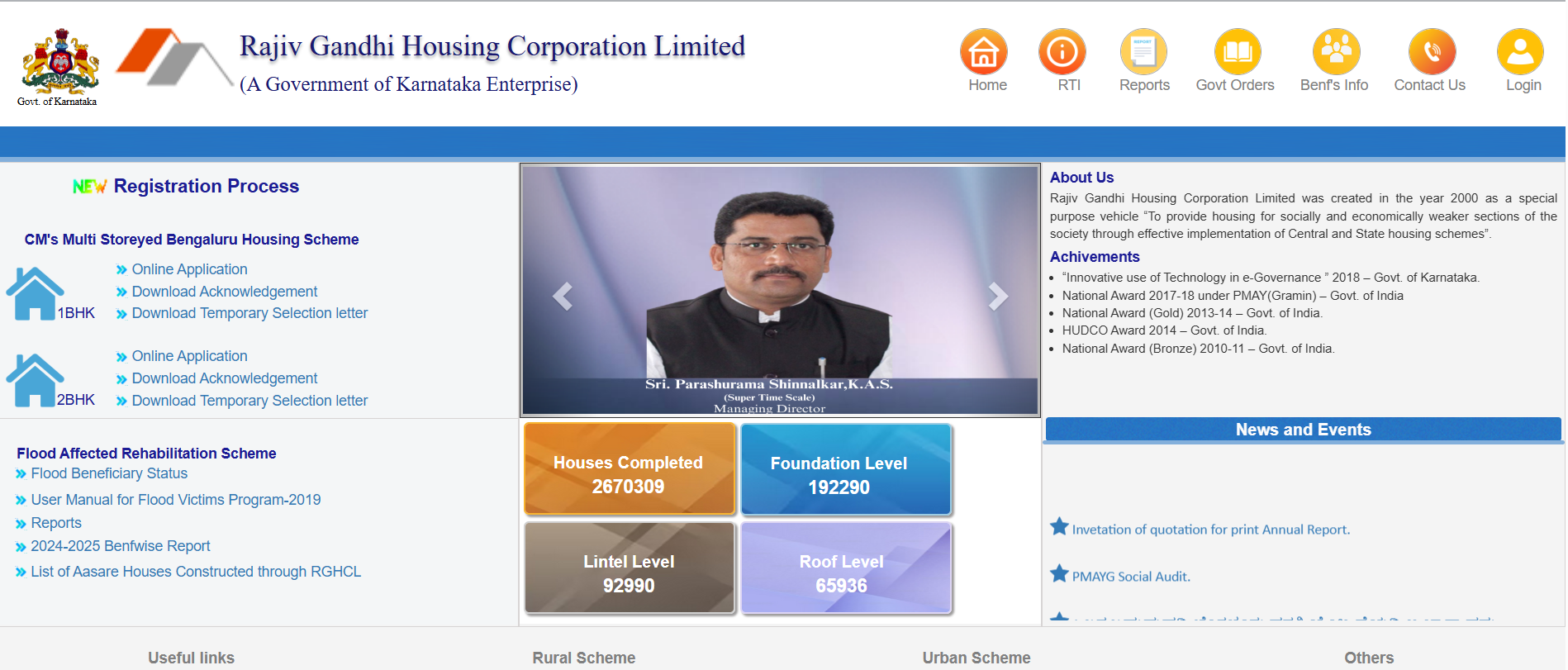

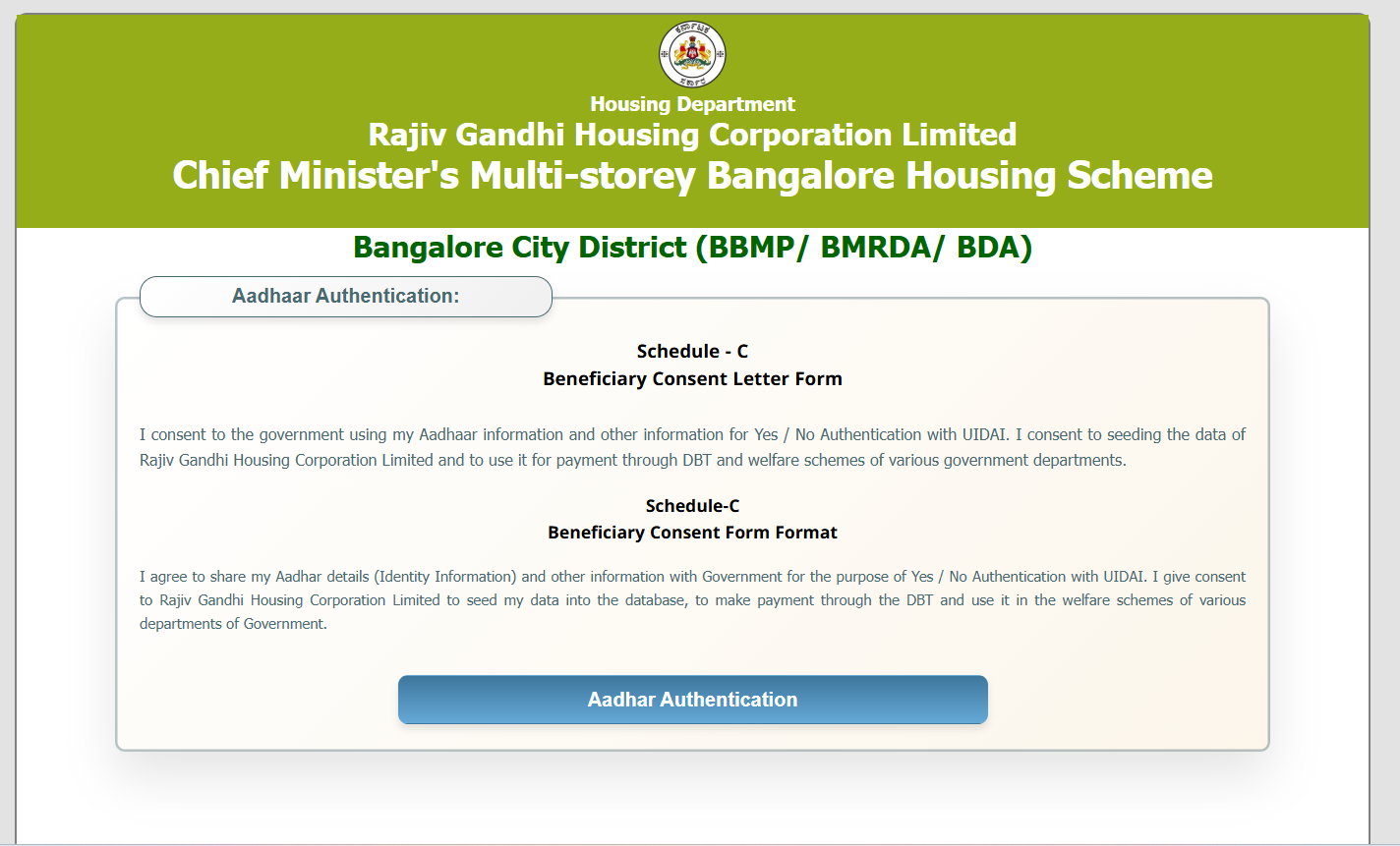

- Visit the Official Rajiv Gandhi Awas Yojana Portal.

- Fill out the online application form with your personal details, including your name, address, income details, and any other required information.

- Submit Required Documents

Identity Proof (Aadhaar card, Voter ID, etc.)

Income Proof (Salary slip, ITR, or bank statements)

Address Proof (Utility bills, ration card, etc.)

Photographs (Passport-sized photo) - Application Verification

Once you have submitted your application, it will be verified by the local authorities. This process checks if you meet the eligibility criteria set under the scheme.

Suggested Read: Afforadable Housing in Noida

How to Check Application Status for Rajiv Gandhi Awas Yojana?

- Visit the official Rajiv Gandhi Awas Yojana portal.

- Log in using your application number or registration details.

- Navigate to the “Application Status” or “Beneficiary Information” section.

- Enter the required application number or details.

- View the current status of your application.

Pattern of Funding Under Rajiv Gandhi Awas Yojana

The funding pattern for the Rajiv Gandhi Awas Yojana is structured based on the population size of the urban area and the geographical region.

| Category | Urban Pockets | Contribution for Housing | Contribution for Infrastructure |

|---|---|---|---|

| Category A | Cities with a population of 5 lakh and above | Central Govt: 50% State Govt: 25% Local Bodies: 0% Beneficiaries: 25% | Central Govt: 50% State Govt: 25 Local Bodies: 25% Beneficiaries: 0% |

| Category B | Cities with a population below 5 lakh | Central Govt: 75% State Govt: 15% Local Bodies: 0% Beneficiaries: 10% | Central Govt: 75%, State Govt: 15% Local Bodies: 10% Beneficiaries: 0% |

| Category C | North Eastern & Special Category States | Central Govt: 80% State Govt: 10% Local Bodies: 0% Beneficiaries: 10% | Central Govt: 80% State Govt: 10% Local Bodies: 10% Beneficiaries: 0% |

For SC/ST/OBC or women beneficiaries: minimum 10% of the cost.

For general beneficiaries: minimum 12% of the cost.

Housing Grants Under Rajiv Gandhi Awas Yojana

| Category | Eligible Areas | Grant Per Dwelling Unit (DU) |

|---|---|---|

| Category A | Urban areas with a population of 5 lakh or more | ₹5 lakh |

| Category B | Urban areas with a population below 5 lakh | ₹4 lakh |

| Category C | Special category states & North-Eastern states | ₹5 lakh |

Suggested Read: DDA Sasta Ghar Housing Scheme

Credit Scheme Under Rajiv Awas Yojana

The Rajiv Rinn Yojana is an essential credit component of the Rajiv Awas Yojana, offering long-term loans with interest subsidies to beneficiaries.

- Interest Subsidy: Offers a 5% interest subsidy for long-term loans with a tenure of 15-20 years.

- Loan Purpose: Helps eligible applicants secure loans for building or purchasing homes under the Rajiv Awas Yojana.

Loan Limits Under Rajiv Rinn Yojana

| Category | Loan Limit |

|---|---|

| Economically Weaker Sections (EWS) | Up to ₹5 lakh |

| Low-Income Groups (LIG) | Up to ₹8 lakh |

Suggested Read: Affordable Home Loans Offered by HFCs

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

If you’re living in a slum area and belong to economically weaker sections or low-income groups, you may be eligible. The scheme is available in cities with populations above or below 5 lakh, and special category states.

You can apply online through the official portal by filling out an application form and submitting required documents like identity proof, income details, and address proof.

Once approved, you’ll receive financial assistance and your housing construction will begin as per the scheme’s guidelines.

The Rajiv Rinn Yojana offers a 5% interest subsidy for long-term loans (15-20 years) for beneficiaries. Loans for EWS are capped at ₹5 lakh, while LIG can get up to ₹8 lakh.

You can get up to ₹5 lakh per dwelling unit, depending on your city’s population category. In smaller cities, the grant is ₹4 lakh, and for special category states, it remains ₹5 lakh.

Yes, the scheme covers both notified and non-notified slums, ensuring everyone in slum areas has an opportunity to benefit from the program.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan