Rajkot’s property‑tax system is the city’s operating system. It is a mandatory tax levied by the Rajkot Municipal Corporation on all immovable properties within the city limits. This tax funds essential civic amenities such as public health services, streetlights, parks, water supply, and roads. The tax rate is determined based on the annual value of the property, which is calculated using various factors.

Who Really Pays RMC Property Tax: Owners, Tenants, or Both?

- Only property owners—whether the building is residential or non‑residential, must pay RMC property tax.

- Tenants are not liable for the tax; the on‑record owner handles the entire payment.

- Non‑profit organisations, religious institutions and government‑owned properties are exempt from RMC property tax.

Suggested Read: Why Investing in Gujarat Real Estate is a Smart Move?

How Is My RMC Bill Calcualted?

First, remember there are two steps:

- Work out the Annual Value (AV) of the property.

- Multiply that AV by the tax‑rate percentage RMC publishes for the current year.

Annual Value = (Unit‑Area Value × Built‑Up Area × Age Factor × Use Factor) – Standard Deduction

What each element means

- Unit‑Area Value: RMC’s ward‑wise rupee rate per square metre—the land’s benchmark price.

- Built‑Up Area: Total floor space of the building, all storeys and wall thickness included.

- Age Factor: Multiplier that tapers valuation as the structure gets older.

- Use Factor: Multiplier keyed to usage—1.0 for homes, higher for shops and offices.

- Standard Deduction: Flat 10 % allowance the Corporation subtracts for routine repairs.

Putting it together

- Multiply the first four components to get a gross annual value.

- Subtract the standard deduction to arrive at the Annual Value.

- Finally, apply the official RMC tax rate (different slabs for residential vs. commercial) to the AV—that product is your property‑tax bill for the half‑year.

Suggested Read: RERA Charges in Gujarat

How to Pay RMC Property Tax Online?

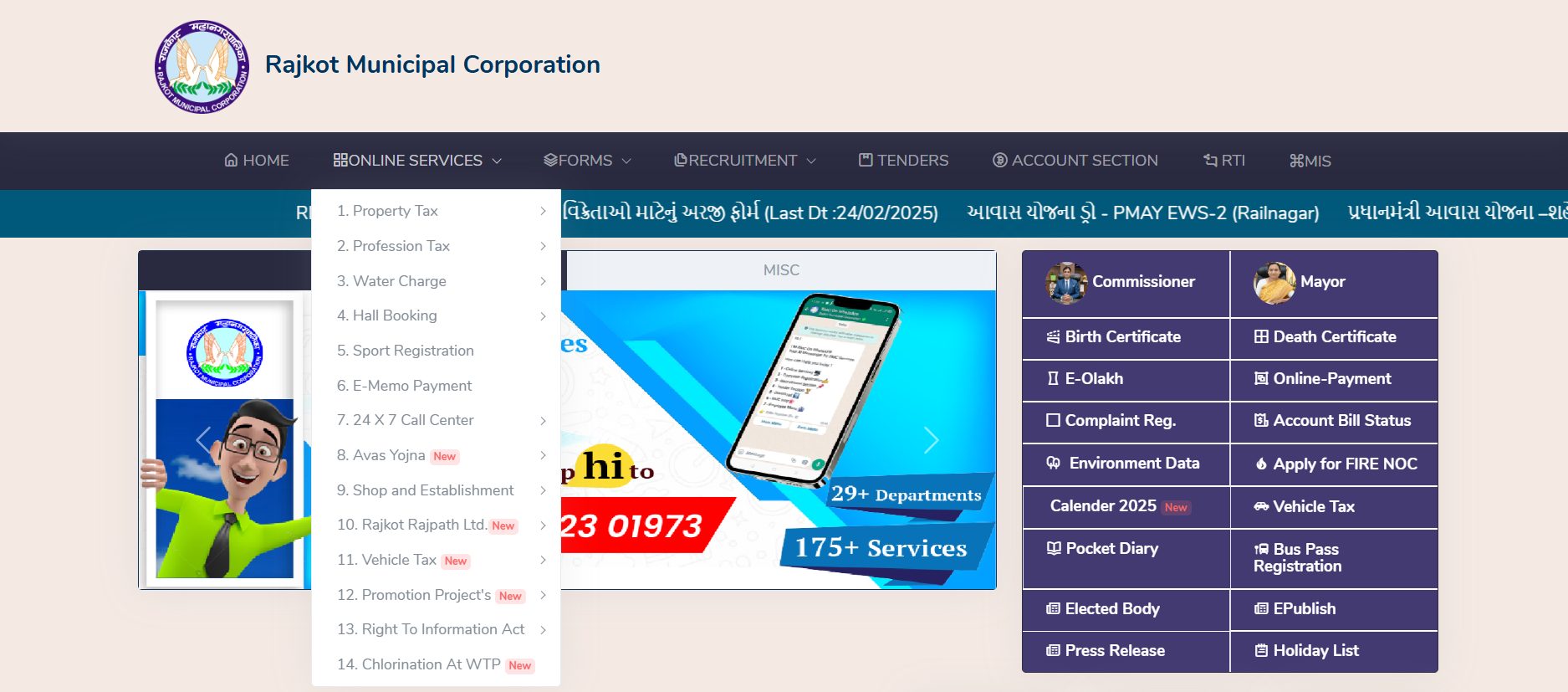

- Visit the official Rajkot Municipal Corporation website (www.rmc.gov.in)

Rajkot Municipal Corporation portal offering online municipal services and resources.

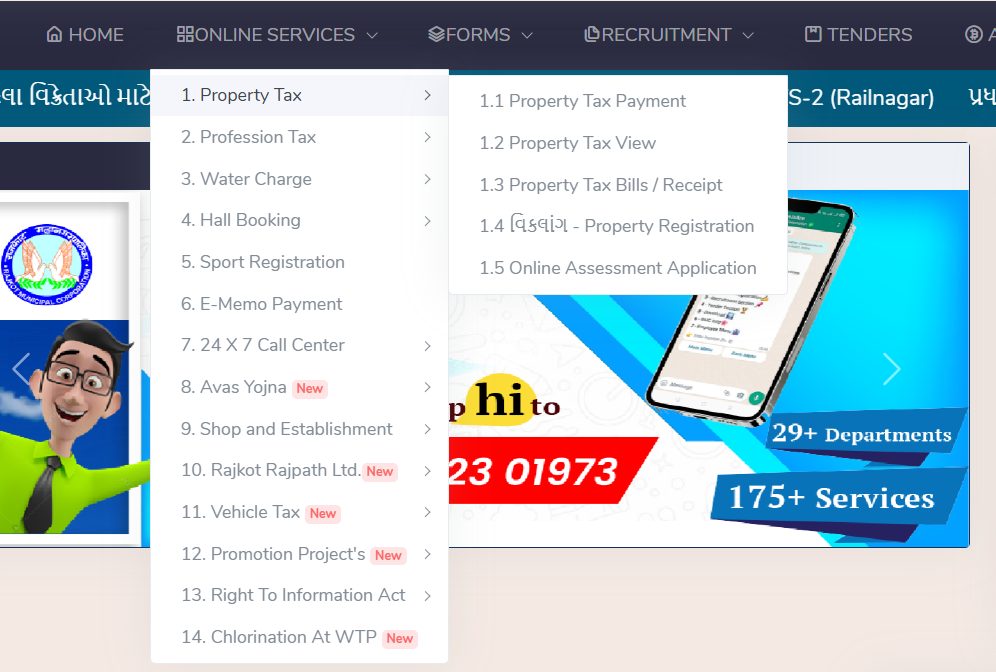

Rajkot Municipal Corporation portal offering online municipal services and resources. - Click on “Online Services” and select “Property Tax”

- Choose “Pay Property Tax Online”

- Enter your property ID, survey number, or owner name.

- Verify property details and confirm the payment amount.

- Select payment mode (net banking, credit/debit card, or UPI)

- Complete the transaction and receive an acknowledgement receipt.

Suggested Read: Stamp Duty and Registration Charges in Gujarat

How to Pay RMC Property Tax Offline?

- Grab the bill: Collect a printed tax notice from the nearest RMC help desk, or download and print it from the portal.

- Head to a partner bank: Walk into any authorised branch of HDFC Bank, Axis Bank, SBI, or ICICI Bank.

- Present the notice: Hand the teller your property‑tax bill.

- Settle the dues: Pay the amount in cash or with a cheque/DD made out to “Rajkot Municipal Corporation.”

- Keep the proof: Collect the stamped receipt and file it safely; it’s your official confirmation of payment.

Suggested Read: Gujarat Land Records (AnyRoR)

What’s the Last Date to Pay and What Happens If You Miss It?

The RMC splits your liability into two equal instalments each financial year:

- First‑half demand: must be cleared on or before 31 March (covers April–September).

- Second‑half demand: due on or before 15 October (covers October–March).

Miss either cut‑off and the clock starts ticking:

- Interest penalty: 18 % per annum, calculated on the outstanding amount until full settlement.

- Notice fee: an additional 0.50 % slapped on when the Corporation issues a formal reminder.

- Escalation risk: chronic default can trigger recovery proceedings, including property‑seizure notices.

Suggested Read: Gujarat Housing Board New Schemes 2025

Are There Any Discounts or Rebates for Paying RMC Property Tax Early?

Paying before the rush isn’t just good practice—it can be cheaper.

- Advance‑payment concession: In FY 2022‑23, RMC knocked 10 % off the bill for taxpayers who settled their full annual dues in one shot before the first‑half deadline.

- Digital‑first bonus: The same year, an extra 1 % rebate rewarded those who used the online portal instead of standing in line.

- Why it matters: RMC routinely reviews these incentives each budget cycle, so check the current circular every April; even a modest rebate can cancel out the impact of inflation on your tax outlay.

Pro‑tip: If you own multiple properties, bulk‑pay them together online, one payment gateway fee, maximum rebate across all holdings.

Check Out: Rental Yield Calculator

What Documents Will I Need When Paying RMC Property Tax?

| Document | Why It’s Needed |

|---|---|

| Current property‑tax bill or demand notice | Shows your Old or New Property Number and exact amount due |

| Last year’s paid receipt | Helps resolve disputes if the current bill is missing or contested |

| Owner’s ID proof (Aadhaar, PAN, voter ID) | Confirms identity at the payment counter |

| Address proof for the property (electricity or water bill) | Allows clerks to cross‑verify the premises details |

| Cheque or demand draft payable to “Rajkot Municipal Corporation” | Alternative to cash for over‑the‑counter payments |

| Digital payment confirmation | Provides evidence if you need to reconcile an online transaction |

Suggested Read: How to Change Your Name in Land Registry or Property Documents?

Am I Eligible for an Exemption on RMC Property Tax?

The following individuals, organisations, and entities are exempt from paying RMC property tax.

- Registered charitable trusts

- Places of worship used only for religious activities

- Buildings owned by the central, state, or local government

- Land or structures that RMC owns or leases for civic services

- Heritage‑listed properties (may receive a partial concession)

Suggested Read: LTCG Tax on Sale of Property

RMC Property Smart Card

The Rajkot Municipal Corporation now issues a chip‑enabled PVC card that stores the key details of your property—survey number, built‑up area, ownership history, and the latest tax status—all in a pocket‑size format. Issued by the Revenue Department for every registered property, it serves as a single source of truth during sales, inheritance, or loan applications.

Why it matters

- Instant verification at banks, sub‑registrar offices, and RMC counters

- Faster resale and mutation processes because data is already authenticated

- Reduced paperwork; no need to carry multiple photocopies of tax receipts and approvals

- Acts as a quick reference for emergency services and insurance claims

Suggested Read: How to Choose the Right Property for Maximum Rental Yield?

Conclusion

Property tax is more than a line item on a bill. It is the capital that resurfaced Kalavad Road, lit Bhakti Nagar after dark, and financed the drainage upgrades that keep monsoon water off your doorstep. By understanding the valuation formula, paying on time, and using digital tools like the RMC smart card and online calculator, owners turn a compliance task into a strategic investment in Rajkot’s resilience and growth.

Frequently Asked Questions

RMC property tax is typically paid bi-yearly. The first half is due by March 31st, and the second half by October 15th of each year.

Consistent non-payment can lead to penalties, legal action, and potentially property seizure. Always communicate with RMC if you’re facing payment difficulties.

Property tax rates may vary based on the location and zoning of your property within Rajkot. Check with RMC for specific rates in your area.

No, agricultural land is usually exempt from property tax.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan